- 注册

-

全球注册

-

注册公司

-

注册香港公司

- 当前位置

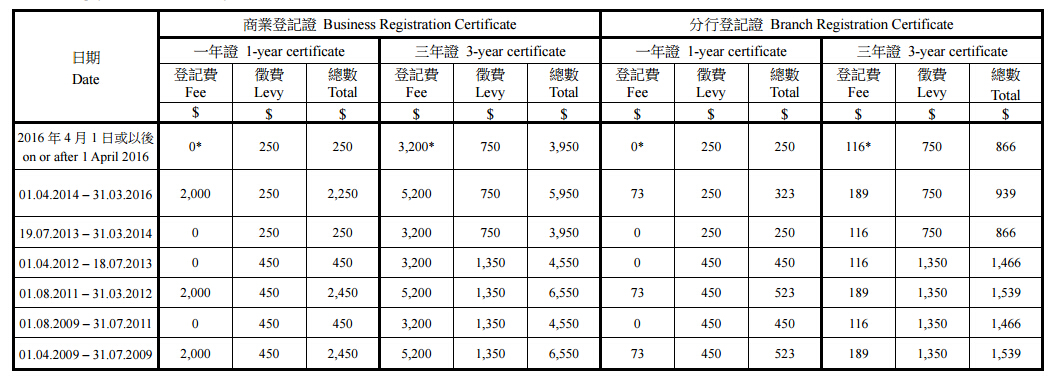

2016-2017年香港商业登记费及征费收费表

2016/03/22

来源:http://www.acius.org

编辑:m_8cad29

{#CustomizeTitleInfoBar}

Note:2016-2017年香港商业登记费及征费收费表

稅務局 Inland Revenue Department 商業登記費及徵費收費表 Business Registration Fee and Levy Table 收費基準商業登記證分一年有效期及三年有效期兩種,除經一站式公司註冊及商業登記服務成立的本地公司外,應繳金額以登記證的開始生效日釐訂。對於非本地公司新開業務,其首張登記證的開始生效日期是有關業務的開業日期,不是申請商業登記或分行登記日期。於一站式公司註冊及商業登記服務下成立的本地公司,其首張商業登記證的應繳金額是以其向公司註冊處提出相關的成立法團遞呈日期釐訂,而該登記證的開始生效日期是它的註冊日期。至於其後發出的續證,應繳金額則以續證的開始生效日釐訂。

Basis of charge

There are two types of business registration certificate, namely 1-year certificate and 3-year certificate. Except for the first registration certificate of local companies falling within the one-stop company and business registration, the amount payable under a certificate depends on the commencement date of the registration certificate. For a new business other than a local company, the commencement date of its first registration certificate is its date of commencement of business, not the date of application for business or branch registration.

For local companies falling within the one-stop company and business registration, the amount payable for the first registration certificate depends on the date of making the related incorporation submission to the Companies Registry and the commencement date of the registration certificate is the date of incorporation. For renewal of certificates, the amount payable is determined by reference to the commencement date of the relevant renewal certificate.

* 2016-17 年度財政預算案建議,有關法例 修訂建議 須經立法會審議及通過,才能生效。

* 2016-17 Budget proposal. The relevant legislative amendment is subject to the scrutiny by the Legislative Council.